Welcome To Player Snips

Please watch the getting started video below before you begin using your new superpowers

Welcome To Player Snips

Please watch the getting started video below before you begin using your new superpowers

Chapter 3: W-2 Tax Return

PS-023

PU-003 - Avatar Bar

This is popup snip that is set to trigger on lesson start. Hover over here and click the Show Popup button to view the popup now.

PU-003

PU-003 - Avatar Bar

This is popup snip that is set to trigger on lesson start. Hover over here and click the Show Popup button to view the popup now.

PU-003

CL-002 - 80% Content Width

This is layout snip will not be visible inside of this window. Hover over here to copy the snippet and then place inside your course lesson.

CL-002

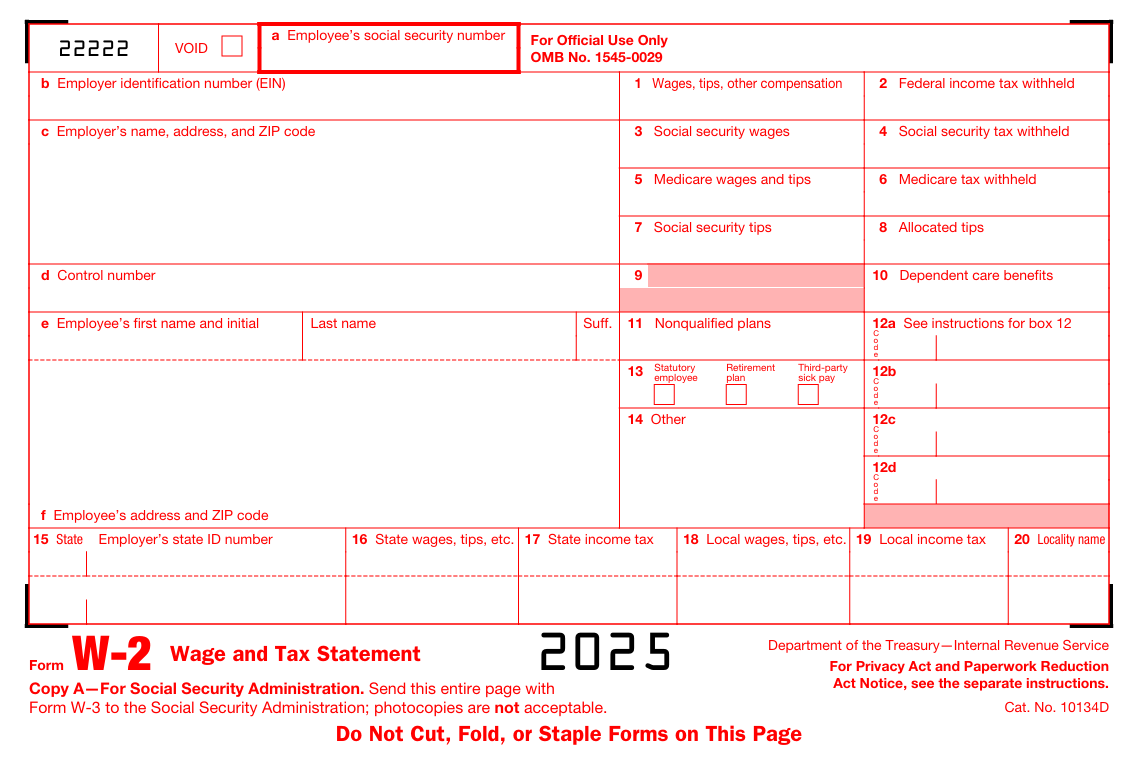

Identifying a W2 Form

PS-006

Form W-2, the Wage and Tax Statement, is crucial for tax return preparation.

Issued yearly by employers to employees and the IRS, it reports wages earned and taxes withheld.

CL-003

Facts about W-2 :

Employers must send Form W-2 to employees and the SSA by January 31.

W-2 is officially called IRS Form W-2 – Wage and Tax Statement.

PS-014

It includes wages, salary, federal, state, and other taxes withheld.

It reports income from the prior calendar year.

It is used to file federal and state income tax returns.

PS-014

Pro Tip:

Before touching the software, always understand what the form represents.

PS-017

Understanding the W-2 Form Layout

PS-007

Locate the following on the W2 form.

PS-022

- 1Box a

- 2Box b

- 3Box 1

- 4Box 2

PS-030

Good Work!

Now check below if the boxes match the descriptions given.

PS-017

Employee Social Security Number

Employer's TIN (Identification number)

Wages, Tips and Other Compensation

Fedral Income Tax Withheld

Check out if the W2 form matches with the one in CCH Axcess Tax software.

PS-036

Nick Jone's W2 Form

It’s mid-January. Like every year, the Jones family has received two W-2 forms.

Nick – from the hospital where he works as a physician:

PS-006

PS-020

Janet Jone's W2 Form

Janet received W2 from the bank where she works as an investment advisor:

PS-007

PS-019

Pro Tip:

Multiple W-2s are common in joint returns. Each must be entered separately.

PS-026

Well Done!

In the next lesson we will see how to enter this information in the software!

PS-017

Glossary

Check out the grossary provided in the course to identify various terms on the forms in detail!

PS-026

- You first navigate to the client’s return.

- Then go to the Income tab and select Add W-2.

- Enter the necessary W-2 information (like employer name, EIN, wages, withholdings, etc.).

- Finally, save the entry to include it in the return.

PS-031

Assignment

W-2 Tax Return Entry

PS-023

Your assignment is:

Open CCH Axcess

Go to the client dashboard

Enter the given W-2 information

Calculate and download the return PDF

Upload the PDF for review

PS-015

Careful!

Do not upload screenshots. Upload the full return PDF only.

PS-018

Identifying the W-2 IRS tax form

Understanding what information it reports

Preparing to enter W-2 data correctly in CCH Axcess

PS-036

What will you learn in this chapter?

PS-006

CL-001 - 100% Content Width

This is layout snip will not be visible inside of this window. Hover over here to copy the snippet and then place inside your course lesson.

CL-001

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

PS-040

What are some facts about W2?

Employers must send Form W-2 to employees and the SSA by January 31.

W-2 is officially called IRS Form W-2 – Wage and Tax Statement.

It includes wages, salary, federal, state, and other taxes withheld.

It reports income from the prior calendar year.

It is used to file federal and state income tax returns.